Burn Multiple: How to Calculate and What Good Looks Like

Master the burn multiple formula, understand benchmarks by stage, and learn proven strategies to improve capital efficiency in your SaaS business.

There was a moment in SaaS history when "growth at all costs" stopped being a strategy and started being a liability.

It happened in 2022. The era of cheap capital ended. Interest rates climbed. Venture investors suddenly cared about profitability again. And a metric that had been lurking in investors' spreadsheets became the single most important number in SaaS: the Burn Multiple.

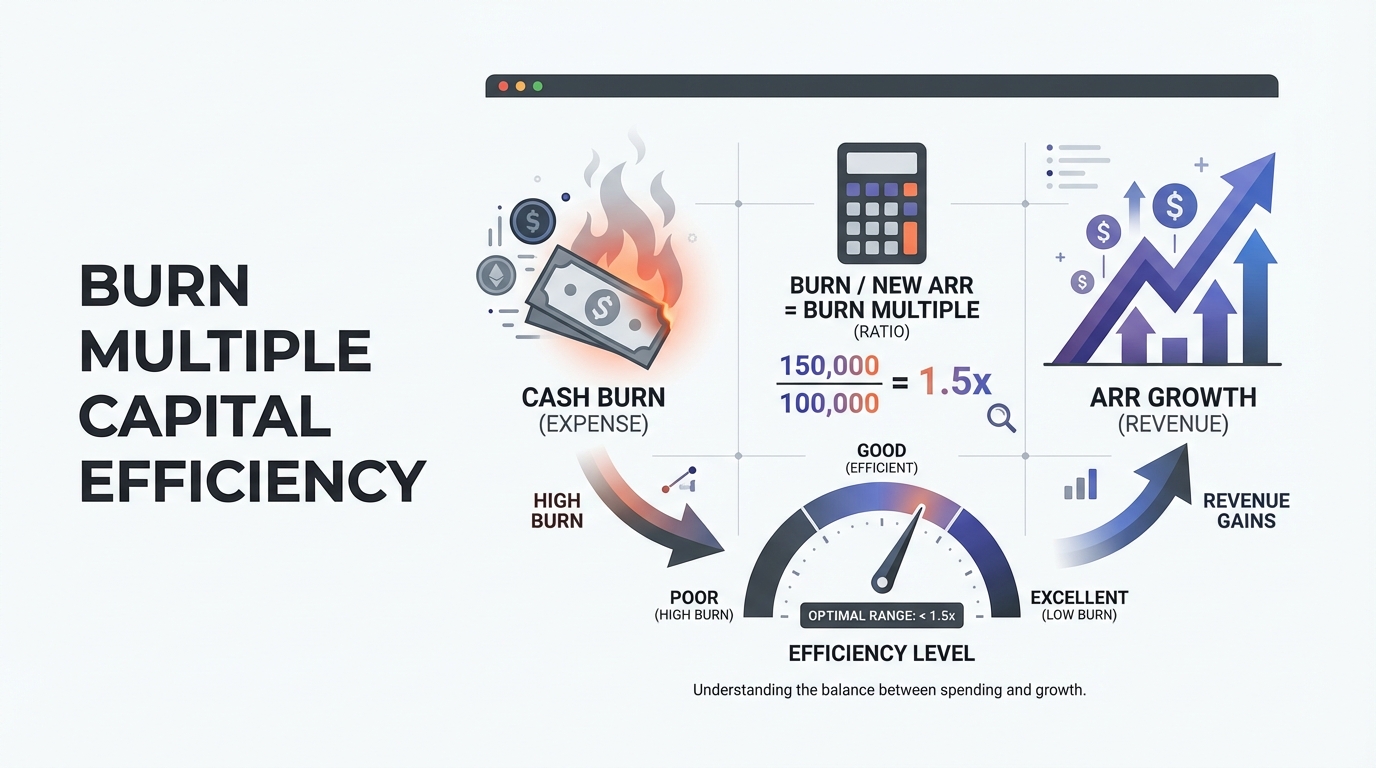

The Burn Multiple measures how much cash you burn for every dollar of ARR you generate. It's the metric that separates companies on a path to sustainable growth from those burning through their runway like a fire hose.

Yet despite its newfound importance, most founders and finance leaders don't fully understand what a "good" Burn Multiple looks like or how to improve it. This guide walks you through the calculation, the benchmarks, and most importantly, how to use this metric to make smarter decisions about how you spend capital.

What is the Burn Multiple?

The Burn Multiple is a measure of capital efficiency. It tells you how much cash your company burns (spends) to generate one dollar of new annual recurring revenue (ARR).

The formula is deceptively simple:

Burn Multiple = Net Burn / Net New ARRBut what it measures is profound: it's the answer to the question "at my current burn rate and growth rate, how long until I run out of money?"

The Origins of Burn Multiple

David Sacks, founder of Yammer and managing partner at Craft Ventures, popularized Burn Multiple in a 2022 essay as the "efficient growth" framework. As venture capital contracted and SaaS companies that had been funded at huge valuations started facing real pressure to reach profitability, investors realized they needed a metric that combined both burn and growth into a single, meaningful number.

Key Insight: Burn Multiple forces founders to think about growth and efficiency together, not separately. You can grow fast and burn a lot of cash. That's expensive. But you can also be efficient and not grow. That's boring. Burn Multiple is about finding the sweet spot.

Why Burn Multiple Matters

Understanding your Burn Multiple is critical for several reasons:

- Runway visibility: Your Burn Multiple directly determines how long you'll survive on current funding. A Burn Multiple of 2.0 with $10M in the bank and $500K net new ARR means you burn through roughly $1M per quarter ($2.0 × $500K).

- Fundraising power: In today's market, investors scrutinize Burn Multiple before looking at almost anything else. A company with a Burn Multiple of 1.5 has fundamentally more leverage in fundraising conversations than one with 3.0.

- Operational discipline: Tracking Burn Multiple forces you to own both sides of the equation: not just revenue growth, but also operational efficiency.

- Path to profitability: Burn Multiple is the key metric that tells you how close you are to profitability. The lower your Burn Multiple, the faster your path to breakeven.

Burn Multiple vs. Other Growth Metrics

It's important to understand that Burn Multiple is different from growth rate. A company growing 100% YoY with a 3.0 Burn Multiple is still inefficient. Conversely, a company growing 40% YoY with a 0.8 Burn Multiple is probably in better shape long-term.

That's the insight that makes Burn Multiple so powerful: it reframes success from "how fast are we growing?" to "how efficiently are we growing?"

Burn Multiple Formula and Calculation

Let's walk through the calculation step by step.

The Formula

Burn Multiple = Net Burn / Net New ARRFormula Components:

| Component | Definition | Calculation |

|---|---|---|

| Net Burn | Cash spent vs. earned each period | Total Cash Out - Total Cash In |

| For SaaS | Operating expenses minus revenue | (R&D + S&M + G&A) - Revenue |

| Net New ARR | ARR added during the period | (Ending ARR - Starting ARR) |

Step-by-Step Example

Let's walk through a real example. Say your company's Q1 looks like this:

Costs:

- R&D: $300,000

- Sales & Marketing: $250,000

- G&A (overhead): $100,000

- Total Spend: $650,000

Revenue:

- Cash collected (customer payments): $150,000

- Total Cash In: $150,000

Growth:

- ARR at start of Q1: $2,000,000

- ARR at end of Q1: $2,300,000

- Gross new ARR added: $300,000

Calculating Net Burn:

Net Burn = $650,000 spent - $150,000 collected = $500,000Calculating Net New ARR:

Net New ARR = $2,300,000 - $2,000,000 = $300,000Calculating Burn Multiple:

Burn Multiple = $500,000 / $300,000 = 1.67This means your company burned $1.67 for every dollar of ARR added. At a quarterly net new ARR of $300,000, you're burning $500,000 per quarter. If you have $2M in the bank, you have approximately 4 quarters of runway.

Important Variations

Monthly Burn Multiple: You can calculate this monthly, but the metric is noisier because monthly revenue and growth fluctuate. Most companies calculate quarterly or trailing 12-month Burn Multiple for stability.

Trailing 12-Month (TTM) Burn Multiple: This smooths out seasonal variations. Calculate net burn and net new ARR over the last 12 months, then divide.

Example:

TTM Net Burn: $2,000,000

TTM Net New ARR: $1,200,000

TTM Burn Multiple = $2,000,000 / $1,200,000 = 1.67TTM is more reliable for forecasting because it accounts for seasonal fluctuations.

Critical Notes on Calculation

- Include all operational costs: Don't try to make your Burn Multiple look better by excluding costs. Include R&D, S&M, G&A, everything. If you're not paying it from customer revenue, it's part of your burn.

- Use the same period for both numerator and denominator: If you calculate net new ARR for Q1, use Q1 net burn. Don't mix quarterly net new ARR with annual burn—that will give you a nonsensical number.

- Net new ARR includes churn: Net new ARR = new customer ARR + expansion ARR - churn. If you're losing customers, that reduces your net new ARR and increases your Burn Multiple.

- Account for one-time items: Unusual one-time costs (legal settlements, acquisitions, major refunds) should be excluded or noted separately. They distort your ongoing Burn Multiple.

What's a Good Burn Multiple?

Burn Multiple ranges vary dramatically by stage. Here's the framework:

Burn Multiple Interpretation

| Burn Multiple | Assessment | Action |

|---|---|---|

| < 1.0 | Amazing. Generating more than $1 ARR per $1 burned | Invest aggressively. You're profitable or very close. |

| 1.0 - 1.5 | Excellent. $1-$1.50 burned per $1 ARR | Sustainable for long-term growth. Investors love this. |

| 1.5 - 2.0 | Good. $1.50-$2.00 burned per $1 ARR | Acceptable for earlier stages. Focus on tightening. |

| 2.0 - 3.0 | Concerning. $2-$3 burned per $1 ARR | Red flag for Series B+. Acceptable only for seed/Series A. |

| > 3.0 | Inefficient. More than $3 burned per $1 ARR | Major problem. Urgent action required on burn or growth. |

What Good Looks Like by Stage

The absolute Burn Multiple that's "good" depends entirely on your stage:

| Stage | ARR Range | Target Burn Multiple | Investor Expectation |

|---|---|---|---|

| Seed | < $500K ARR | 2.0-3.0 | Learning mode. Minimal churn but low revenue. |

| Series A | $500K - $3M ARR | 1.5-2.0 | Evidence of improving efficiency. Number trending down. |

| Series B | $3M - $10M ARR | 1.0-1.5 | Real progress toward sustainability required. |

| Series C+ | $10M+ ARR | < 1.0 | Very close to profitability or already there. |

| Growth Stage | Post-Series C | < 1.0 or cash-positive | Managing for profitability, not just growth. |

Seed Stage (< $500K ARR): Burn Multiple of 2.0-3.0 is acceptable. You're in learning mode. You haven't figured out product-market fit yet, and your revenue is minimal. Investors expect inefficiency at this stage.

Series A ($500K - $3M ARR): Burn Multiple of 1.5-2.0 is your target zone. You should be showing evidence of improving burn efficiency. Investors expect to see the number trending downward, not upward.

Series B ($3M - $10M ARR): Burn Multiple of 1.0-1.5 is required. At this stage, investors are expecting real progress toward sustainability. A Burn Multiple above 2.0 is a serious concern and will severely limit your fundraising options.

Series C+ ($10M+ ARR): Burn Multiple < 1.0 is the expectation. You should be very close to profitability or already there. A Burn Multiple above 1.5 signals serious operational problems.

Growth Stage (post-Series C, profitable or near-profitable): Burn Multiple < 1.0 or you're already cash-positive. These companies are managing for profitability, not growth.

The Stage Progression Framework

Here's how to think about Burn Multiple as you scale:

- Seed: "Growth at all costs. Burn Multiple is secondary."

- Series A: "Growing and beginning to optimize. Target 1.5-2.0, trending down."

- Series B: "Efficient growth. Target 1.0-1.5. Must be sustainable."

- Series C+: "Path to profitability clear. Target < 1.0 or profitable."

The key is trending downward at each stage. If you're Series A and your Burn Multiple is improving quarter-over-quarter, investors will be impressed even if the absolute number is high. If it's worsening, that's a red flag regardless of the number.

Burn Multiple vs. Other Metrics

Burn Multiple isn't the only efficiency metric that matters. Here's how it compares:

Efficiency Metrics Comparison

| Metric | Focus | Best For |

|---|---|---|

| Burn Multiple | Path to profitability (growth efficiency) | Early-stage companies (pre-profitability) |

| Rule of 40 | Balance between growth and profitability | Mature SaaS companies near or at profitability |

| CAC Payback | Sales efficiency specifically | Evaluating your sales motion |

| Magic Number | GTM efficiency (ARR / S&M spend) | Optimizing go-to-market strategy |

Burn Multiple vs. Rule of 40

Rule of 40 says that growth rate + profit margin should equal 40 or higher. A company growing 30% with a 10% margin scores 40. A company growing 50% but with a -20% margin also scores 40.

- Burn Multiple: Focused on the path to profitability (how efficiently you're growing)

- Rule of 40: Focused on the balance between growth and profitability (once you're near profitable)

When to use each:

- Use Burn Multiple for early-stage companies (pre-profitability)

- Use Rule of 40 for mature SaaS companies near or at profitability

A Series A company optimizing Burn Multiple is essentially on a path to eventually score well on Rule of 40.

Burn Multiple vs. CAC Payback

CAC Payback measures how long it takes one customer to pay back their acquisition cost.

- Burn Multiple: Measures total company efficiency

- CAC Payback: Measures sales efficiency specifically

A company could have a great CAC Payback (12 months) but a bad Burn Multiple (3.0) if they're spending heavily on R&D or G&A. Conversely, a company could have a weak CAC Payback (24 months) but a great Burn Multiple (0.8) if they have strong expansion revenue or low overhead.

Burn Multiple vs. Magic Number

Magic Number measures sales and marketing efficiency specifically (new ARR / S&M spend).

- Burn Multiple: Measures total company efficiency (net burn / net new ARR)

- Magic Number: Measures GTM efficiency (new ARR / S&M spend)

A company could have an excellent Magic Number (1.0+, meaning efficient sales) but a terrible Burn Multiple (3.0, because R&D and G&A are too high). This is actually common in infrastructure/platform companies with high R&D costs.

Burn Multiple by Sales Motion

Different types of companies have different natural Burn Multiples based on their business model:

By Sales Motion

| Sales Motion | Typical Burn Multiple | Characteristics |

|---|---|---|

| Product-Led Growth (PLG) | 0.8-1.5 | Highly efficient customer acquisition (viral, low CAC) |

| Sales-Led | 1.5-2.5 | Higher customer acquisition costs, longer sales cycles |

| Enterprise/Hybrid | Varies widely | High ACV but long sales cycles; depends on deal mix |

Product-Led Growth (PLG): Typically 0.8-1.5 Burn Multiple because customer acquisition is highly efficient (viral, low CAC). Examples: Slack, Figma, Notion (early days).

Sales-Led: Typically 1.5-2.5 Burn Multiple because customer acquisition costs are higher. These companies spend more on sales and marketing relative to their ARR.

Enterprise/Hybrid: Varies widely depending on the mix. Enterprise deals have high ACV but long sales cycles, leading to higher Burn Multiples during the sales cycle phase.

Geographic Variation

US-based SaaS: Generally 1.5-2.0 Burn Multiple for growth-stage companies. Lower margins due to high costs.

International/remote-first: Can achieve 0.8-1.2 Burn Multiple due to lower operating costs.

How to Improve Your Burn Multiple

If your Burn Multiple is above your target, you have two levers to pull: reduce burn or increase ARR. Let's explore both:

Lever 1: Reduce Burn

Burn reduction is the obvious path, but it requires discipline and specificity. Don't just cut across the board. Strategic burn reduction means cutting inefficient spending while doubling down on what works.

R&D Spending:

- Pause or kill low-ROI projects. Which features are customers not using?

- Reduce technical debt paydown. Focus on customer-facing work.

- Outsource non-core development. Hire contractors for projects you don't want to maintain.

Sales & Marketing Spending:

- Kill underperforming channels. If paid ads have a 3.0 CAC Payback but content has 12 months, redirect budget.

- Improve sales team productivity. Focus on higher-value deals rather than volume.

- Reduce CAC through word-of-mouth and referral programs.

G&A Spending:

- Reduce headcount in non-revenue-generating functions. Every hire should either improve the product or help acquire/retain customers.

- Renegotiate vendor contracts. SaaS tools, office space, professional services.

- Move to remote-first to reduce real estate costs.

Real example: A Series B company reduced their Burn Multiple from 2.8 to 1.6 by:

- Cutting 15% of R&D spend (killed 3 low-traction features)

- Reducing paid advertising by 40% (low-ROI channel)

- Cutting G&A by 20% (reduced headcount, cut expenses)

This was painful but necessary and took 2 quarters.

Lever 2: Increase Net New ARR

This is the longer-term path and often more sustainable. Growing your way out of a bad Burn Multiple requires accelerating revenue growth without proportional increase in burn.

Improve conversion rates:

- Better sales training and messaging

- Faster time-to-value (product improvements)

- Better lead qualification (focus on high-probability deals)

Increase expansion revenue:

- Upselling and cross-selling to existing customers

- Usage-based pricing (if applicable)

- Premium features and higher tiers

Improve retention (reduce churn):

- Better onboarding and implementation

- Regular customer success engagement

- Product improvements and bug fixes

Real example: A Series A company improved their Burn Multiple from 2.5 to 1.6 by:

- Improving sales conversion rate from 15% to 20% (better messaging, demo practices)

- Reducing churn from 3% monthly to 2% monthly (better onboarding)

- Adding expansion revenue from 10% of ARR to 15% (new premium tier)

This took longer (4-6 quarters) but was sustainable and didn't require cutting staff.

The Optimal Strategy

Most companies improve their Burn Multiple using a combination:

- 50% from burn reduction - Cut inefficient spending, especially early on

- 50% from growth improvement - Drive higher-efficiency revenue growth

The balance depends on your situation. If you're in a poor Burn Multiple situation and running low on runway, you need to cut now (burn reduction). If you have 18+ months of runway, focus on improving growth efficiency.

Burn Multiple in Fundraising

Here's the hard truth: your Burn Multiple is probably the second question a VC will ask after "what's your revenue?" It's literally the metric that determines your lifespan.

How VCs Use Burn Multiple

Investors use Burn Multiple to calculate your implied runway:

Implied Runway (quarters) = (Cash in Bank) / (Net Quarterly Burn)But they also think about Burn Multiple in terms of capital efficiency. A company with $50M in the bank and a 1.5 Burn Multiple generating $1M net new quarterly ARR has enough runway for 7-8 years (assuming constant growth). That's a company that can be selective about the next funding round.

A company with $10M in the bank, $500K quarterly ARR, and a 3.0 Burn Multiple is burning $1.5M per quarter and has only 2.5 years of runway. They need to fix this before their next fundraise, or they'll get crushed on valuation.

What to Do If Your Burn Multiple Is High

First, don't lie about it. VCs will figure it out. Instead:

1. Show the trend: "Our Burn Multiple was 3.0 last year, but we've improved it to 2.4 this year and we're on track for 2.0 by year-end." Improvement matters more than the absolute number.

2. Explain the reason: "We're in heavy R&D investment for platform expansion, but we're expecting to achieve profitability on our core product line within 18 months." Context matters.

3. Show your path to improvement: Have a credible plan to reach an acceptable Burn Multiple within 2-4 quarters. VCs want to see that leadership understands the problem and has a specific action plan.

4. Fundraise ahead of the problem: If your Burn Multiple is worsening, raise capital sooner rather than later. A company with 18 months of runway and a deteriorating Burn Multiple has way more leverage than one with 6 months.

The Shift to Efficient Growth

2021: The Era of Growth at All Costs

In 2021, if you were a SaaS company, the playbook was simple: grow as fast as possible, raise capital at high valuations, and worry about profitability later. The mantra was "growth at all costs." Companies with Burn Multiples of 3.0-4.0 were celebrated for their "ambition."

Many of those companies are now struggling. When capital dried up and growth slowed, they realized they had no path to profitability.

2022-2026: The Era of Efficient Growth

The market correction changed everything. The new expectation is:

- Burn Multiple < 1.5 by Series B, regardless of growth rate

- Burn Multiple < 1.0 by Series C

- Path to profitability visible in 18-24 months at Series B+

This isn't pessimism about growth. It's pragmatism. Investors learned the hard way that growth without efficiency is just expensive burn.

What This Means for Your Company

If you're fundraising or scaling in 2026, here's what you need to know:

- Your Burn Multiple matters more than your growth rate

- Improving Burn Multiple quarter-over-quarter is more impressive than hitting high absolute growth

- Having a clear path to profitability (even if you're years away) is essential

- "How much longer until you're profitable?" is a question you should be able to answer confidently

Burn Multiple Benchmarks: Public Company Examples

Here's what Burn Multiple looked like for some famous SaaS companies at IPO:

| Company | IPO Year | ARR at IPO | Annual Net Burn | Annual Net New ARR | Burn Multiple |

|---|---|---|---|---|---|

| Slack | 2019 | ~$500M | ~$10M | ~$150M | ~0.07 |

| Datadog | 2019 | ~$230M | ~$30M | ~$90M | ~0.33 |

| Twilio | 2016 | ~$150M | ~$25M | ~$50M | ~0.50 |

| Zoom | 2019 | ~$330M | Minimal | ~$200M+ | < 0.1 |

The Trend: All of these companies had sub-1.0 Burn Multiples by IPO time. The market demands efficiency at scale.

Limitations and Considerations

Burn Multiple is powerful, but like any single metric, it has blind spots:

Doesn't Account for Market Timing

A company with a 2.0 Burn Multiple in a hot market might be in better shape than one with 1.0 in a downturn. Burn Multiple alone doesn't tell you about market opportunity.

Can Be Manipulated

You can technically improve your Burn Multiple by:

- Accelerating annual contracts (pull revenue forward)

- Cutting spend on future growth (short-term fix)

- One-time revenue windfalls

Smart investors look at the trend and the underlying business, not just the snapshot number.

Doesn't Account for Profitability Mix

A company with a 2.0 Burn Multiple but improving each quarter is healthier than one at 1.2 but deteriorating. Always look at the trend.

Action Checklist

Ready to improve your Burn Multiple? Follow these steps:

- [ ] Calculate your Burn Multiple for the last 4 quarters

- [ ] Plot the trend: is it improving or worsening?

- [ ] Compare against stage-appropriate benchmarks

- [ ] Identify your biggest burn categories (R&D, S&M, G&A)

- [ ] Calculate efficiency of each spending category

- [ ] Create a quarterly improvement plan with specific targets

- [ ] Track Burn Multiple monthly alongside growth rate

Conclusion

The Burn Multiple is the metric that matters most in today's SaaS market. It's the single number that combines your burn and your growth into a measure of capital efficiency.

Calculate your Burn Multiple quarterly and track the trend. If it's improving, you're on the right path. If it's worsening, you have a problem that needs fixing.

The goal isn't necessarily to achieve a Burn Multiple of 0.5 overnight. It's to have a credible plan to improve it quarter-over-quarter, reaching your stage-appropriate target (1.5-2.0 for Series A, 1.0-1.5 for Series B, < 1.0 for Series C+).

Companies that master their Burn Multiple—that balance growth and efficiency—are the ones that build sustainable, profitable SaaS businesses. And in the current market, that's not just nice to have. It's essential.