CAC Payback Period: Calculator, Formula, and Benchmarks for SaaS Companies

Learn how to calculate CAC payback period, compare against industry benchmarks, and improve this critical SaaS metric that determines your cash flow efficiency.

CAC Payback Period: Calculator, Formula, and Benchmarks

You just spent $50,000 acquiring a customer. When does that investment pay for itself?

That simple question—and its answer—determines whether your company needs $5 million or $50 million to reach profitability. It's the difference between running a sustainable business and operating on a hamster wheel of perpetual fundraising.

This is what CAC Payback Period measures. It's arguably more important than raw Customer Acquisition Cost (CAC) because it accounts for monetization. A $100,000 CAC for a customer paying $50,000/month becomes profitable in about 2.5 months. That same $100,000 CAC for a customer paying $5,000/month takes 20 months to recover—a fundamentally different business problem.

In this guide, we'll show you exactly how to calculate your CAC Payback Period, benchmark it against industry standards, and implement practical strategies to improve this critical metric.

What is CAC Payback Period?

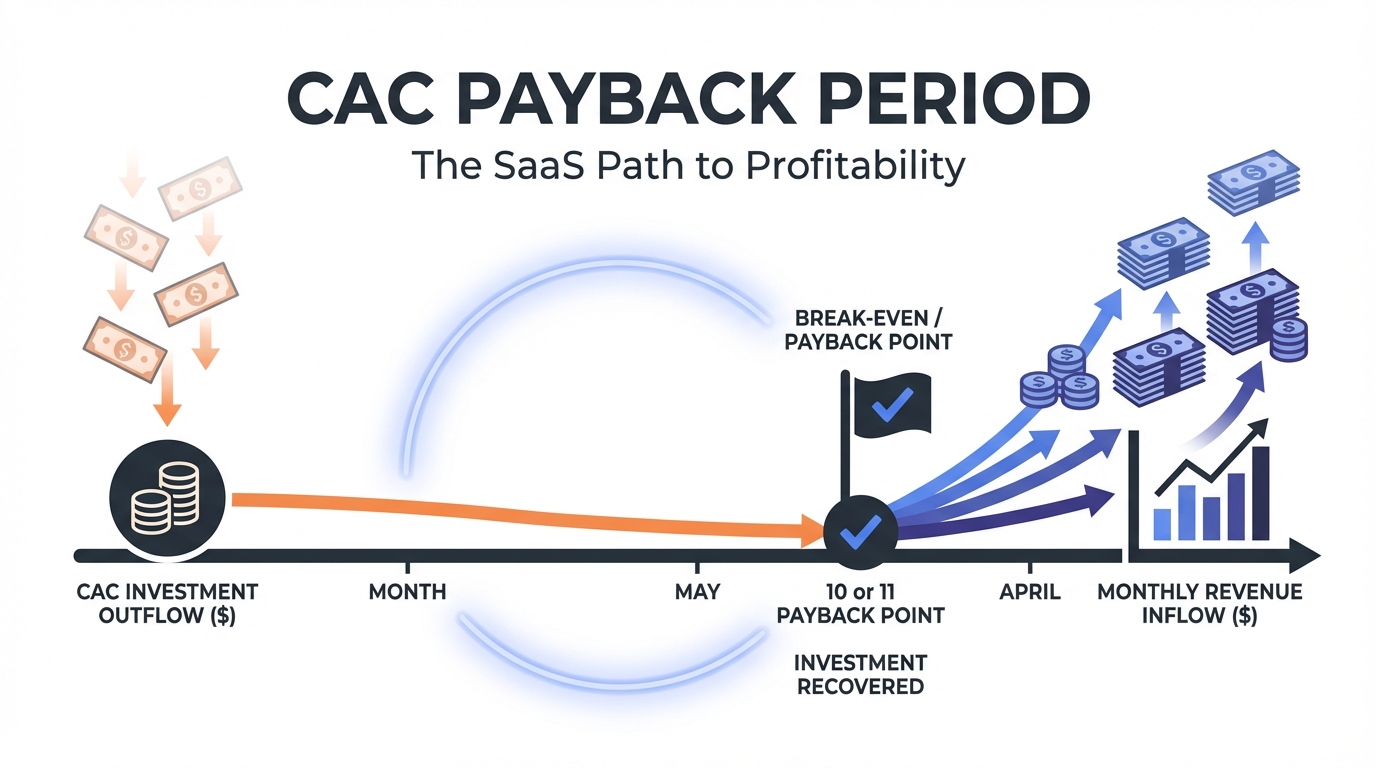

CAC Payback Period is the number of months it takes for a customer to generate enough profit to recover the cost of acquiring them.

In other words: How long before a customer's revenue contribution covers the sales and marketing expenses spent to land that customer?

For a startup with $1 million in annual marketing spend acquiring 100 customers, you're spending $10,000 to acquire each customer. If each customer generates $2,000/month in profit contribution, your payback period is 5 months. After month 5, every dollar that customer generates is pure profit lift (assuming they stick around).

Why CAC Payback Period Matters More Than Raw CAC

Here's the trap most founders fall into: they obsess over CAC while ignoring payback. A $50,000 CAC sounds expensive. But if you're selling $200,000/year contracts to enterprise customers with 80% gross margins, that customer becomes profitable in 1.5 months. The $50,000 investment is trivial relative to the return.

Conversely, a $1,000 CAC sounds cheap. But if you're a freemium SaaS product with a $10/month ARPU and 60% gross margin ($6 contribution), that payback period is 166 months. You'd need the customer to stick around for 14 years just to break even on the acquisition cost.

CAC Payback Period reveals the true cash flow implications of your growth strategy. It answers a question investors ask immediately: How much cash do you need to survive to profitability?

Key Insight: CAC Payback Period is the metric that determines whether you can afford to scale or whether you're on a treadmill requiring endless capital raises.

The Cash Flow Crisis

This is where the metric becomes crucial for fundraising strategy. Let's say you're a $1M ARR SaaS company growing 10% month-over-month. Your CAC is $5,000 and your payback period is 12 months.

To hit $2M ARR, you need to acquire customers aggressively. Let's say you acquire 100 new customers. That's $500,000 in customer acquisition spend this year. But those customers won't become profitable for 12 months. You need enough cash on hand to absorb that $500,000 spend while you wait for the cohort to mature.

A company with a 3-month payback period can spend $500,000 on marketing and recover the investment 9 months earlier. That's the difference between needing $2M in the bank and $1M in the bank.

The CAC Payback Formula

Here's the standard formula:

CAC Payback Period (months) = CAC / (Monthly Profit Contribution per Customer)Where "Monthly Profit Contribution per Customer" is typically calculated as:

Monthly Profit Contribution = (ARPA × Gross Margin %)Putting it together:

CAC Payback Period = CAC / (ARPA × Gross Margin %)Formula Components

Let's break down each variable:

| Variable | Definition | Example |

|---|---|---|

| CAC | Total marketing and sales spend / number of new customers acquired | $100,000 spend ÷ 50 customers = $2,000 |

| ARPA | Average Revenue Per Account (monthly) | 100 customers paying avg $500/month = $500 ARPA |

| Gross Margin % | Revenue remaining after COGS (servers, infrastructure, payment processing) | $500 revenue - $100 COGS = 80% margin |

Worked Example: Mid-Market SaaS Company

Let's calculate the CAC Payback Period for a SaaS company with these metrics:

- CAC: $8,000 (spent $200,000 on sales/marketing, acquired 25 customers)

- ARPA: $1,500/month (average customer pays $1,500 per month)

- Gross Margin: 70% (COGS is 30% of revenue)

Step 1: Calculate Monthly Profit Contribution

Monthly Profit Contribution = $1,500 × 0.70 = $1,050Step 2: Calculate Payback Period

CAC Payback Period = $8,000 / $1,050 = 7.6 monthsThis means it takes 7.6 months for the average customer to generate enough profit to cover the $8,000 acquisition cost.

The Impact of Gross Margin

Gross margin has a dramatic effect on payback period. Let's compare two companies with identical CAC ($8,000) and ARPA ($1,500) but different gross margins:

Scenario 1: High-margin SaaS (80% GM)

Payback = $8,000 / ($1,500 × 0.80) = $8,000 / $1,200 = 6.7 monthsScenario 2: Infrastructure-heavy SaaS (50% GM)

Payback = $8,000 / ($1,500 × 0.50) = $8,000 / $750 = 10.7 monthsThe company with 80% gross margin becomes profitable 4 months earlier. That's the difference between a sustainable model and one that requires much more capital to scale.

CAC Payback Period Benchmarks

The "acceptable" payback period depends heavily on your business model, customer type, and stage. Here's the framework:

Universal Benchmarks

| Payback Period | Assessment | Context |

|---|---|---|

| < 12 months | Ideal | Healthy growth, recovers CAC before typical churn window |

| 12-18 months | Acceptable | Reasonable for mid-market/enterprise with larger contracts |

| 18-24 months | Concerning | Requires long customer lifetime and low churn to justify |

| > 24 months | Danger Zone | High-risk, requires significant capital to reach profitability |

Benchmarks by Business Model

The payback period benchmark differs drastically by how you sell:

Self-Serve / Product-Led Growth (PLG)

Target: < 6 months

Self-serve businesses have lower CAC and higher churn. You need payback to happen quickly because a typical customer might stick around for 18-24 months before leaving. With a 6-month payback, you get 12-18 months of pure profit before they churn.

Examples: Slack's early years, Zoom, Notion, Figma

SMB Sales-Led

Target: 6-12 months

SMB customers cost more to acquire (inside sales, account management) but have lower churn than self-serve. 6-12 months payback is the sweet spot.

Examples: HubSpot (early), Zapier, Calendly

Mid-Market

Target: 12-18 months

Longer sales cycles and higher CAC (enterprise sales teams), but longer customer lifetime and higher expansion revenue. 12-18 months payback is acceptable because customers often stick for 3-5 years.

Examples: Salesforce, Workday (early), Slack (enterprise segment)

Enterprise

Target: 18-24 months

Enterprise deals have massive CAC (enterprise sales team + long sales cycle) but extremely high lifetime value. Customers often stay for 5+ years. 18-24 months payback is acceptable because the LTV is so large.

Examples: Okta, Datadog, Twilio (enterprise segment)

Why Gross Margin Matters More Than Most Founders Realize

Let's look at a real example of how gross margin changes everything:

Company A: Low Infrastructure Costs

- CAC: $5,000

- ARPA: $500/month

- Gross Margin: 85%

- Payback: 11.8 months

Company B: High Infrastructure Costs

- CAC: $5,000

- ARPA: $500/month

- Gross Margin: 40%

- Payback: 25 months

Same CAC. Same pricing. Dramatically different payback periods because one company has massive infrastructure costs.

This is why many founders ignore CAC payback in their early years—they're growing revenue but haven't yet optimized infrastructure costs. As you scale, infrastructure becomes a lever. Here's how:

Optimize your tech stack. Use managed services instead of building from scratch. Share infrastructure across products. Upgrade your database architecture.

Negotiate vendor costs. Once you hit scale, you can negotiate better rates on cloud infrastructure, payment processing, and other services.

Improve efficiency. Auto-scaling, caching, database indexing, and CDN usage can dramatically reduce per-customer COGS.

Raise prices without raising costs. Feature-based or usage-based pricing lets you capture margin without increasing infrastructure spend proportionally.

Important: For every 10% improvement in gross margin, you improve CAC payback by approximately 11% (the inverse relationship). That's a massive lever.

CAC Payback by Segment: Real-World Examples

Let's look at how payback varies by customer segment within a single SaaS company:

Example: Design Collaboration Tool

| Tier | CAC | ARPA | Gross Margin | Payback Period |

|---|---|---|---|---|

| Self-serve (SMB designers) | $500 | $120/month | 85% | 4.9 months |

| Team tier (Mid-size agencies) | $5,000 | $2,000/month | 82% | 3.0 months |

| Enterprise tier | $80,000 | $15,000/month | 78% | 6.8 months |

Notice something interesting? The enterprise segment actually has the longest payback period despite the massive ARPA. Why? Because CAC scales even faster than ARPA in enterprise. But the payback is still under a year because the contract is so large.

The self-serve segment has fast payback because organic acquisition costs almost nothing.

The team segment has the best overall economics—reasonable acquisition cost with high ARPA.

This is why many SaaS companies deliberately shift from pure self-serve to a "self-serve + sales" model. The team segment is often the goldilocks zone: high ARPA, reasonable CAC, fast payback.

How to Improve CAC Payback Period

Improving payback means either reducing CAC or increasing the monthly profit contribution (ARPA × GM%). Here's the playbook:

Reduce CAC

Improve Marketing Efficiency

Better product marketing, optimized funnels, and product-led growth tactics reduce CAC. If you're running ads with a 4% conversion rate and you can improve to 6%, that's a 33% CAC reduction.

Increase Sales Productivity

Higher close rates and lower time-per-deal reduce CAC. This comes from better lead quality, improved pitch, and sales training.

Build Word-of-Mouth

Word-of-mouth is nearly free CAC. A viral coefficient of 1.2 (each customer brings 1.2 others) cuts your acquisition cost dramatically.

Change GTM Model

Moving from pure PLG to PLG + sales, or building an agency partner channel, can actually reduce CAC by reaching customers more efficiently.

Increase ARPA

Raise Prices

The simplest lever. If you increase price by 10% and keep CAC constant, you improve payback by 10% without any operational change.

Expand Pricing Tiers

Add a premium tier that captures more value from power users without increasing infrastructure cost.

Implement Usage-Based Pricing

Price based on consumption so high-value customers pay more without you having to do anything.

Increase Average Contract Value Through Packaging

Bundle features or seats to increase the starting price.

Improve Gross Margin

Optimize Infrastructure

Database optimizations, caching, and switching to more efficient cloud infrastructure can improve margin by 10-15%.

Reduce Payment Processing Fees

Processing fees are often 2-3% of revenue. Negotiating better terms or switching providers can improve margin.

Build More Efficient Products

Products that require less compute per customer naturally have higher margins.

The Compounding Effect

Here's where it gets interesting. Improvements in each area compound:

Original State

- CAC: $5,000

- ARPA: $1,000

- GM: 70%

- Payback: 7.1 months

After Improvements

- CAC: $4,000 (20% reduction through better marketing)

- ARPA: $1,200 (20% increase through pricing)

- GM: 75% (5% improvement through infrastructure)

New Payback = $4,000 / ($1,200 × 0.75) = $4,000 / $900 = 4.4 monthsYou've cut the payback period from 7.1 months to 4.4 months—a 38% improvement—by making modest improvements across three levers. That's the power of compounding operational efficiency.

CAC Payback in Investor Conversations

Investors care deeply about CAC Payback because it's a proxy for cash efficiency. Here's how to present it:

Best Practices for Investor Communication

Show the payback by cohort. Don't just give one number. Show how payback has improved or worsened over time. "Our CAC payback has improved from 14 months to 9 months over the past 12 months, primarily through improved gross margins."

Compare to your cohort benchmarks. Show you understand your segment. "For a self-serve SaaS company, our 7-month CAC payback is in the 75th percentile."

Connect to cash runway. Help investors understand the cash implications. "With $4M in the bank and $2M annual spend, our 10-month payback gives us the runway to scale to profitability."

Show the payback trend. Trends matter more than absolute numbers. Improving payback signals you're getting more efficient as you scale. Worsening payback signals a problem—either rising CAC or falling ARPA.

Explain the drivers. Break down what's moving payback. "Our payback improved because we reduced CAC through more efficient paid channels while increasing ARPA through product expansion."

CAC Payback Limitations

This metric is powerful but not complete. Here are the blind spots:

What CAC Payback Doesn't Show

- [ ] Customer lifetime: A 12-month payback is great if your average customer stays for 3 years. It's terrible if they churn after 14 months. Always pair this metric with churn rate.

- [ ] Absolute cash needs: A 6-month payback at $100/month ARPA versus $10,000/month ARPA require very different cash reserves to scale.

- [ ] Revenue expansion: If your expansion revenue is significant (customers upgrading, additional seats), the true payback is better than the simple calculation shows.

- [ ] Seasonality effects: Summer cohorts might pay back faster than winter cohorts. Early-year customers might behave differently than later-year customers.

Quick Reference: CAC Payback Summary

Calculation Formula

CAC Payback Period = CAC / (ARPA × Gross Margin %)Target Benchmarks by Model

| Business Model | Target Payback |

|---|---|

| PLG / Self-Serve | < 6 months |

| SMB Sales-Led | 6-12 months |

| Mid-Market | 12-18 months |

| Enterprise | 18-24 months |

Improvement Levers

- Reduce CAC - Marketing efficiency, sales productivity, word-of-mouth

- Increase ARPA - Pricing optimization, premium tiers, usage-based pricing

- Improve GM - Infrastructure optimization, reduced processing fees

The Bottom Line

CAC Payback Period is where growth metrics meet cash flow reality. It's the metric that determines whether you can afford to scale or whether you're on a treadmill requiring endless capital raises.

A payback period under 12 months is the threshold for sustainable SaaS growth. It means you can grow without becoming pathologically dependent on perfect churn rates and infinite expansion. It means each customer acquired makes your path to profitability shorter.

Track it by customer segment, monitor the trend, and obsess over improving it. That's what separates companies that build sustainable businesses from those that burn through capital to maintain growth theater.

Related Reading: