Rule of 40 vs Rule of 50: Which SaaS Metric Matters in 2026?

Compare the Rule of 40 and Rule of 50 to understand which efficiency metric your SaaS should target based on stage, business model, and market conditions.

Rule of 40 vs Rule of 50: Which Metric Matters in 2026

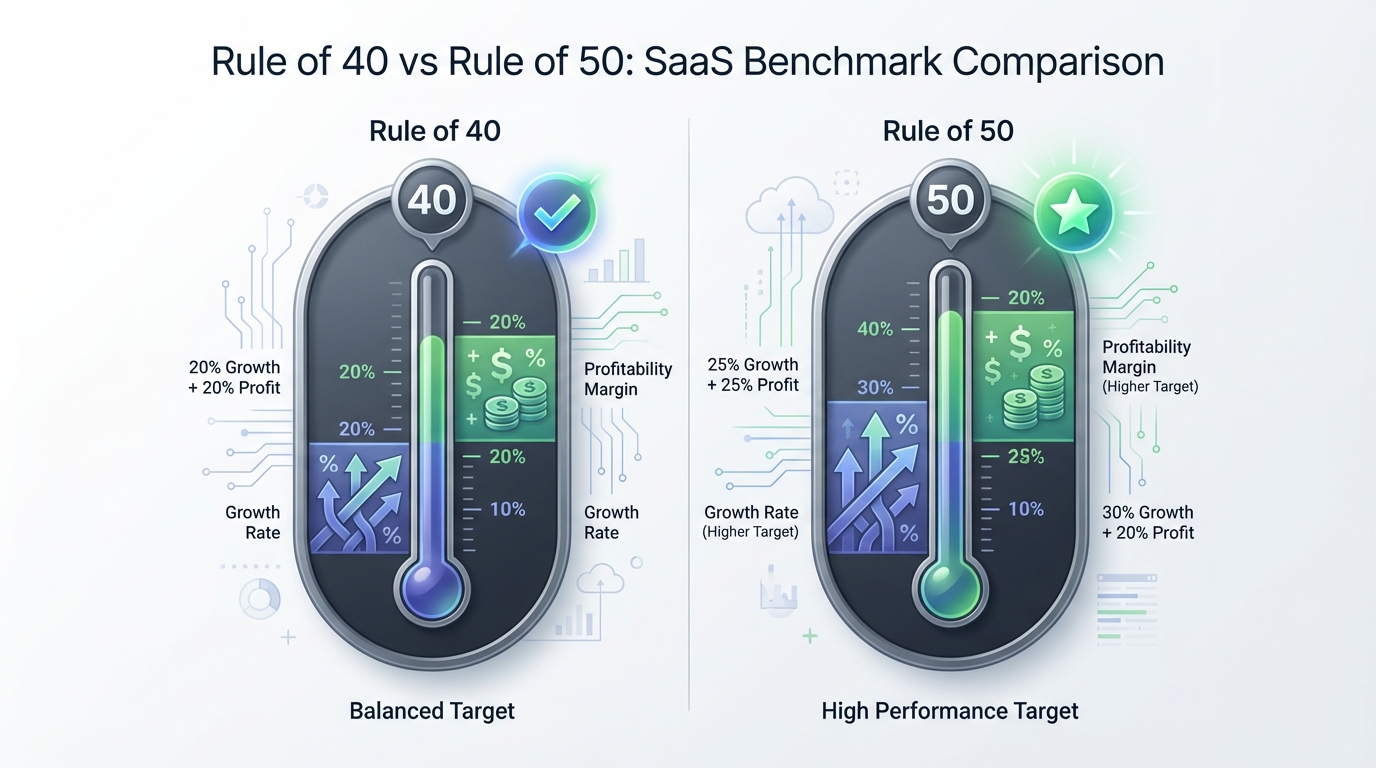

The Rule of 40 has been the sacred benchmark for SaaS companies for over a decade. If your growth rate plus profit margin equals at least 40, you're healthy. If not, you're leaving money on the table.

But in 2026, a new metric is rising: the Rule of 50.

The companies setting the pace—Figma, Retool, Linear, and others—are hitting 50+ on the combined growth and profitability scale. Investors are starting to expect it. Founders are asking: "Do I need to hit Rule of 50 to compete?"

The honest answer is: it depends on your business and your ambitions. But understanding what both rules measure, how they differ, and when each matters is critical for strategic planning.

This post breaks down both metrics, shows you how to calculate them, and helps you decide which one should guide your growth strategy.

What Is the Rule of 40?

The Rule of 40 is elegantly simple: Growth Rate + Profit Margin ≥ 40%

It combines two opposing forces in business: growth (revenue increase) and profitability (cash generation). The idea is that healthy SaaS companies balance these two dimensions.

The Origin: Brad Feld's Framework

Brad Feld popularized the Rule of 40 in 2015, drawing from analysis of publicly traded SaaS companies. The insight was that companies hitting this threshold had sustainable, balanced business models. They grew fast enough to stay competitive but were profitable enough to fund that growth.

Before Feld, SaaS culture was divided:

- Growth at all costs: Spend everything on acquisition; profitability is a later problem (Uber, WeWork mentality)

- Profitable and slow: Focus on margins; miss market opportunities

The Rule of 40 offered a middle path: "You can have both, but you have to trade off one for the other."

Which Metrics to Use

This is where it gets tricky. The Rule of 40 can be calculated multiple ways:

Method 1: Revenue Growth + EBITDA Margin

Rule of 40 = YoY Revenue Growth % + EBITDA Margin %Most common for comparing public companies.

Example:

- Slack: 30% revenue growth + 15% EBITDA margin = 45 (Rule of 40 exceeded)

- Salesforce: 20% growth + 5% EBITDA margin = 25 (below Rule of 40)

Method 2: Revenue Growth + FCF Margin

Free Cash Flow margin is more conservative (it includes capital expenditures). Use this if you want a "truer" view of profitability:

Rule of 40 = YoY Revenue Growth % + FCF Margin %Method 3: Revenue Growth + Operating Margin

Operating margin (operating income / revenue) is in between EBITDA and FCF:

Rule of 40 = YoY Revenue Growth % + Operating Margin %For private SaaS companies, Method 3 (operating margin) is most common because it's what your financial statements actually show.

Why 40 Was the Magic Number

Why 40 and not 30 or 50? It's pragmatic:

- Too low (30): Almost any growing company would qualify. No differentiation.

- Too high (50): Almost no company qualifies. Not aspirational.

- Goldilocks (40): Meaningful threshold that works for healthy, mature SaaS.

For a company at Series B or later, hitting 40 means:

- You're growing (minimally 10-15% if you're barely profitable)

- You're generating cash (minimally 20-25% margin if you're growing 20%)

- You're not trading one entirely for the other

Rule of 40 Formula and Calculation

Let's work through realistic examples.

Example 1: High-Growth, Moderately Profitable Company

Figma (as of 2024 estimates):

- YoY Revenue Growth: 30%

- Operating Margin: 15%

- Rule of 40 Score: 30 + 15 = 45

Figma scores higher because it's in growth mode. Investors accept lower margins from high-growth companies.

Example 2: Mature, Profitable Company

Datadog (2024 actual):

- YoY Revenue Growth: 20%

- Operating Margin: 25%

- Rule of 40 Score: 20 + 25 = 45

Datadog hits 45 through balance. Slower growth but higher margins.

Example 3: Below Rule of 40

Company X (struggling):

- YoY Revenue Growth: 15%

- Operating Margin: 10%

- Rule of 40 Score: 15 + 10 = 25

Below 40. This company needs to either accelerate growth or improve profitability.

Calculation Components

| Component | Definition | Where to Find It |

|---|---|---|

| Revenue Growth | (Current Year Revenue - Prior Year Revenue) / Prior Year Revenue | Income statement |

| Operating Margin | Operating Income / Revenue | Income statement |

| EBITDA Margin | EBITDA / Revenue | Financial statements or calculation |

| FCF Margin | Free Cash Flow / Revenue | Cash flow statement |

Note: Some investors use EBITDA instead of operating margin (more generous). Some use FCF (more conservative). The number changes, but the principle stays the same: you're balancing growth and profitability.

Enter the Rule of 50

The Rule of 50 is simple: Growth Rate + Profit Margin ≥ 50%

It's the Rule of 40, plus 10 percentage points. But that small shift represents a significant change in expectations.

Why 50 Became the New Target

Several factors drove this elevation:

1. Market Inflation

In the 2010s, hitting 40 was elite. In 2020-2021 (the SaaS boom), companies were hitting 60-80 by sacrificing all profitability for growth. So 40 became the bare minimum for "healthy."

2. The Efficiency Era (2022-2026)

After the 2022 downturn, the market demanded both growth AND profitability from day one. "Efficient growth" became the buzzword. Suddenly, companies that hit 50+ were seen as truly elite—they could grow fast without burning cash.

3. Public Market Valuations

Public SaaS companies hitting 50+ trade at 15-20x revenue. Those hitting 40 trade at 8-12x. The market rewards efficiency dramatically.

4. Who's Advocating for Rule of 50

- Bessemer Venture Partners wrote about the "Rule of 50 companies" in 2023

- Figma, Linear, Retool, Loom all hit 50+ in recent years

- Investor decks now expect founders to map out a path to 50, not 40

Evidence from Public Markets (2026)

Looking at publicly traded SaaS companies in early 2026:

| Company | Growth | Margin | Rule of 40 Score | Rule of 50? |

|---|---|---|---|---|

| Figma | 30% | 22% | 52 | ✅ Hit |

| Linear | 28% | 25% | 53 | ✅ Hit |

| Retool | 45% | 8% | 53 | ✅ Hit |

| Datadog | 20% | 25% | 45 | ❌ Miss |

| Salesforce | 18% | 22% | 40 | ❌ Miss |

| HubSpot | 24% | 8% | 32 | ❌ Miss |

The leaders hit 50+. The mature giants, 40-45. The laggards, below 40.

Rule of 40 vs 50: When Each Applies

Rule of 40: Baseline for "Healthy" SaaS

Use Rule of 40 as your baseline target if:

- [ ] You're a Series A/B company still proving growth can be sustainable

- [ ] Your market is competitive and you need to maintain growth rate to compete

- [ ] Your business has 60-70% gross margins (typical SaaS); hitting 40 is genuinely hard

- [ ] You're bootstrapped or profitable and need to prove you can scale profitably

What Rule of 40 tells you: "This company won't burn out. It can fund its own growth over time."

Rule of 50: Elite/Premium Valuation Territory

Aim for Rule of 50 if:

- [ ] You're Series C or later with serious ambitions to be a category leader

- [ ] You have a >75% gross margin product (PLG, developer tools)

- [ ] You're fundraising from top-tier VCs who expect efficient growth

- [ ] You want a >15x revenue multiple valuation

- [ ] You're building a company that will IPO and needs investor-grade metrics

What Rule of 50 tells you: "This company is rare. It doesn't sacrifice growth for profitability or vice versa."

By Company Stage

| Stage | Metric | Target Score | Why |

|---|---|---|---|

| Seed | Neither | Focus on growth | Profitability can wait |

| Series A | Rule of 40 | 30-35 starting | Proving path to 40 |

| Series B | Rule of 40 | 35-45 | Hitting or near 40 |

| Series C+ | Rule of 50 | 45-55 | Proving Rule of 50 path |

| Public | Rule of 50+ | 50+ expected | Market expects this |

By Market Conditions

| Condition | Expectation |

|---|---|

| Bull market (2020-2021) | Rule of 40 was easy; investors wanted Rule of 60+ (all growth) |

| Correction (2022) | Rule of 40 became the minimum for survival |

| Recovery (2023-2026) | Rule of 50 became the new elite bar |

2026 Benchmarks: How the Best Companies Score

Using publicly available data and analyst estimates for early 2026:

Top Performers (Rule of 50+)

| Company | Score | Breakdown |

|---|---|---|

| Figma | 52 | 30% growth + 22% margin |

| Linear | 53 | 28% growth + 25% margin |

| Retool | 53 | 45% growth + 8% margin |

| Stripe (estimated) | 50+ | 35-40% growth + 12-15% margin |

Solid Performers (Rule of 40-49)

| Company | Score | Breakdown |

|---|---|---|

| Datadog | 45 | 20% growth + 25% margin |

| Monday.com | 42 | 17% growth + 25% margin |

| Okta | 43 | 18% growth + 25% margin |

Below Rule of 40

| Company | Score | Breakdown |

|---|---|---|

| Slack | 39 | 20% growth + 19% margin |

| Zoom | 35 | 15% growth + 20% margin |

| HubSpot | 32 | 24% growth + 8% margin |

Stage-Appropriate Targets

| Stage | Realistic Target | Context |

|---|---|---|

| Seed (Year 1-2) | 15-20 | Focus on product-market fit, not profitability |

| Series A (Year 3-4) | 25-35 | Prove scalability |

| Series B (Year 5-7) | 35-45 | Approach Rule of 40 |

| Series C+ (Year 8+) | 45-55+ | Rule of 50 path |

Important: Early-stage companies can't hit these numbers because they're pre-revenue or barely profitable. Don't benchmark against Figma when you're a Series A.

Industry Variations

Some industries naturally score higher or lower:

| Industry | Typical Score | Why |

|---|---|---|

| Developer Tools | 45-55 | High margins (80%+), rapid adoption |

| Enterprise SaaS | 40-45 | Sales-heavy (lower margins), slower growth |

| Horizontal SMB SaaS | 35-40 | Competitive, lower margins, slower growth |

| Consumer SaaS | 30-35 | High churn, competitive, low margins |

Developer tools and PLG companies naturally score higher because they have better unit economics. Don't expect a sales-driven enterprise SaaS company to hit 50.

The Math: Growth vs Profitability Tradeoffs

This is where the Rule of 40/50 gets interesting. You can hit the same score with wildly different combinations.

Different Paths to 40

Path 1: 60% growth + (-20%) margin = 40

(This is "growth at all costs" — you're burning money to grow)

Path 2: 30% growth + 10% margin = 40

(Balanced growth and modest profitability)

Path 3: 20% growth + 20% margin = 40

(Slower growth but stronger profitability)

Path 4: 10% growth + 30% margin = 40

(Mature company, focus on profitability)All score 40. But are they equally healthy?

Which Combination Is "Better"?

| Market Context | Preferred Path | Why |

|---|---|---|

| Bull market | Path 1 (high growth, burn cash) | Investors pay for growth |

| Bear market | Path 2-3 (balanced) | Investors want proof you can fund growth |

| At maturity | Path 4 (profitable, slow growth) | Investors want cash generation |

| Current market (2026) | Path 2-3 preferred | Market rewards companies that grow 25%+ while generating cash |

Key insight: The Rule of 40 doesn't tell you which path to take—only that you need to pick one and be transparent about it.

Market's Current Preference (Early 2026)

The "efficient growth" era means investors prefer:

25-35% growth + 10-20% margin = 40-55

This combination shows you can scale without burning cash. It's more sustainable than 60% growth + negative margin, which will eventually exhaust your runway.

How to Improve Your Rule of 40/50 Score

You have two levers. Pull both.

Lever 1: Accelerating Growth Efficiently

Don't just grow faster—grow more efficiently.

Growth Acceleration Tactics

Improve unit economics: Every dollar spent on acquisition should return $3-5 over customer lifetime (LTV:CAC ratio).

Focus on viral growth: Build features that cause customers to invite others. This reduces CAC dramatically.

Shift to product-led growth: If you're sales-driven, transition to PLG. This often doubles your growth rate while reducing CAC.

Land and expand: Acquire customers cheaply (even at low initial ARPU) and expand revenue per customer. Slack and Figma mastered this.

Example: Company goes from 15% growth + 10% margin to 25% growth + same margin by improving conversion funnels and viral loops. That's a +10 improvement.

Lever 2: Improving Margins Without Killing Growth

The trap: Cut costs and you'll slow growth. Avoid this trap.

Instead:

Margin Improvement Without Growth Sacrifice

Improve gross margin: Every 1% gross margin improvement = 1% potential operating margin improvement. Reduce COGS through automation, negotiation, or technical optimization.

Reduce CAC: More efficient acquisition = better unit economics = higher LTV:CAC ratio = sustainable at higher growth rates.

Reduce operating expenses: Every percentage point you cut from non-CAC opex (R&D, G&A) becomes margin. But only do this if it doesn't slow product development.

Increase prices: Value-based pricing often increases ARPU by 20-30% without changing churn. That's pure margin expansion.

Example: Company improves gross margin from 70% to 75% (+5%), reduces CAC through better conversion (+3% margin improvement), and reduces opex as % of revenue by 2%. That's +10 improvement to operating margin.

Sequencing Improvements

| Year | Focus | Example |

|---|---|---|

| Year 1 | Improve growth rate | 25% → 30% growth (hold margin steady) |

| Year 2 | Improve margin | 15% → 20% margin (hold growth steady) |

| Year 3 | Balance both | 32% growth + 22% margin = 54 score |

Most companies improve growth first, then profitability. This is smart because growing revenue makes margin improvements easier.

Limitations and Criticisms of Rule of 40/50

The Rule of 40 is simple and useful, but it has real blind spots.

Oversimplification Concern

Problem: A company with 60% growth and -20% margin scores the same as one with 30% growth and 10% margin. But the second company is obviously healthier—it's actually generating cash.

Fix: Report Rule of 40 score alongside absolute cash burn. If you're below 0% margin, note it.

Doesn't Account for NRR

Problem: A company with 40% growth from churn-heavy customers acquiring lots of new customers isn't the same as one with 40% growth from existing customers expanding. The second has better dynamics.

The Rule of 40 captures neither NRR nor churn, which are critical to SaaS unit economics.

Fix: Report Rule of 40 alongside NRR and CAC payback. A complete picture requires multiple metrics.

Size and Scale Considerations

Problem: A $1M ARR startup growing 100% with -50% margin isn't comparable to a $100M ARR company growing 50% with 20% margin. Both hit 50, but different rules apply.

Growth slows as you scale. A company must improve profitability as it matures, or the Rule of 40 becomes harder to hit.

Fix: Use stage-appropriate targets. Don't benchmark your Series A company against public SaaS norms.

Manipulation Potential

Some companies game Rule of 40 by:

- Recognizing revenue differently to boost growth rate

- One-time cost cuts to boost margin temporarily

- Counting losses as negative costs (technically correct but misleading)

Fix: Insist on audited financials. Look at 3-year trends, not one-year scores.

Using Rule of 40/50 in Practice

How to actually use these metrics to make decisions.

Board Reporting

Include in your board deck:

Rule of 40 Score: 42 (28% growth + 14% margin)

Rule of 50 Score: 42 (same metrics; missed 50 target)

3-Year Trend:

- 2024: 35 (30% growth + 5% margin)

- 2025: 38 (28% growth + 10% margin)

- 2026: 42 (28% growth + 14% margin)

Path to 50:

Option A: Improve growth to 35% (hold margin at 14%) + profitability initiatives

Option B: Improve margin to 22% (hold growth at 28%) + efficiency gainsThis shows investors you understand your metrics and have a path forward.

Strategic Planning

Use Rule of 40/50 to plan your next 12-24 months:

- Calculate your current score: Where do you stand?

- Choose your priority: Growth or margin?

- Set specific targets: "We'll grow from 25% to 28% AND improve margin from 8% to 12%"

- Assign accountability: Which team owns growth? Which owns margin?

- Measure quarterly: Track toward your Rule of 40 target

Fundraising Positioning

When pitching investors:

| Stage | Positioning |

|---|---|

| Series A | Show path to Rule of 40 by Series C |

| Series B | Explain strategy to hit Rule of 40 within 18 months |

| Series C | Present Rule of 50 path; explain why you'll hit it and when |

Different investor types care about different targets:

- Growth VCs care more about growth rate; Rule of 40 is minimum bar

- Efficient growth VCs want Rule of 50 path from day one

- Growth equity firms expect Rule of 50 already

Acquisition Evaluation

When evaluating potential acquisitions:

| Rule of 40 Score | Valuation Multiple | Assessment |

|---|---|---|

| Below 40 | 6-8x revenue | Only acquire if you can quickly improve unit economics |

| 40-45 | 10-12x revenue | Standard SaaS acquisition |

| 50+ | 12-15x+ revenue | Premium valuation; expect to pay more |

Which Metric Should Guide Your Strategy?

Here's the simple answer:

Choose Rule of 40 if:

- [ ] You're pre-Series C

- [ ] You're in a competitive market where growth rate matters for survival

- [ ] Your current score is below 35

Choose Rule of 50 if:

- [ ] You're Series C+ with genuine ambitions to be a category leader

- [ ] You have strong unit economics (LTV:CAC >3:1)

- [ ] You want to attract top-tier investors or prepare for IPO

Honest take: Most SaaS companies should aim for Rule of 40 first. It's achievable, meaningful, and sustainable. Rule of 50 is the elite tier—great to aim for, but not required to build a $100M+ business.

The metric that matters most is the one that aligns with your fundraising stage and market position. Pick one, understand why it matters for your business, and report it transparently.

Quick Reference: Rule of 40 vs Rule of 50

Calculation

Rule of 40/50 = Revenue Growth % + Profit Margin %Target Scores

| Stage | Rule of 40 Target | Rule of 50 Readiness |

|---|---|---|

| Series A | 30-35 | Not yet relevant |

| Series B | 35-45 | Starting to matter |

| Series C+ | 40-50 | Critical metric |

| Public | 50+ | Market expectation |

Improvement Priorities

| Current Score | Priority Action |

|---|---|

| < 30 | Fix fundamental unit economics |

| 30-40 | Accelerate growth OR improve margin |

| 40-50 | Balance improvements in both |

| 50+ | Maintain efficiency while scaling |

Conclusion

The Rule of 40 and Rule of 50 are both useful frameworks, but they measure different things:

- Rule of 40: Can you balance growth and profitability?

- Rule of 50: Can you grow fast AND profitably, without compromise?

Neither is a guarantee of success. Both are useful targets for focus and communication.

In 2026, the market has clearly elevated expectations. Where Rule of 40 was elite in 2015, it's now baseline for healthy growth-stage companies. Rule of 50 is emerging as the new elite marker.

But don't mistake the number for the insight. The real power is understanding your growth rate, your margins, and the tradeoffs you're making between them. Report both metrics. Improve both metrics. And adjust your target based on your stage and ambitions.

The companies winning in 2026 aren't hitting Rule of 40 by accident. They're hitting it (or aiming for Rule of 50) because they understand their unit economics and have deliberately built a business model that works.

Related Reading: